Land regulations

1. Land Use Rights and Land Use Right Certificate

Private ownership of land is not permitted in Vietnam and the people hold all ownership rights with the State as the administrator. However, the laws of Vietnam allow ownership of a right to use land. This right is called the Land Use Right (“LUR”). LUR to foreign investors allows title holders to conduct real estate transactions, including mortgages.

There are three main regimes for investors to acquire LURs from the States:

• Allocation: The State can allocate LURs by administrative decision to national entities only. Allocated LURs can be subject to a land use fee or not, depending on the cases.

• Recognition: The State can "recognize" LURs to national entities only, in which case no fee is applicable.

• Leasing: The State can lease LURs on the basis of a contract to both national and foreign entities. LURs leases are subject to a land use rent and are the only form of land ownership available to foreigners.

Foreign investors in Vietnam obtain LURs (a) by way of a JVC to which a local Vietnamese partner contribute LUR as capital contribution, or (b) by way of land leased directly from certain permitted lessors such as the State.

2. Land Lease

A foreign investor may lease the land directly from the Government after he/she establishes an FIC in Vietnam.

Lessors permitted to lease land to FICs

Previously, FICs in Vietnam could only lease land from the Government or sublease land from an infrastructure developer. In addition to these lessors, the current Land Law has allowed FICs, which are set up by foreign investors in Vietnam, to lease land from:

• Vietnamese economic organizations (including State-owned companies), private joint stock companies, and limited liability companies;

• overseas Vietnamese citizens; or

• an existing FIC which leases land from the Government and develops infrastructure facilities on the land, provided that this existing FIC has paid the land rental for the whole land lease term.

The Land Law only allows the lessor who has obtained the land under the “allocation” regime (as opposed to the land “lease” regime) to lease his or her land to FICs. The one exception where the land obtained by the lessor under the “lease” regime can be subleased to FICs is when:

• the Vietnamese Party has leased the relevant land before the effective date of the current Land Law, i.e., 1 July 2004; and

• the land lease has been prepaid in full for the whole or for the majority of the lease term and the remaining prepaid term is at least 05 years.

Land Contribution by Local Parties to Joint Ventures

It is a matter of practice that Joint Ventures in Vietnam have local partners contribute their portion of capital in the form of the LUR value. In this case, the local partner’s land payment must not be sourced directly from the State budget.

Under the Land Law, the Vietnamese party to a Joint Venture may make capital contributions in the form of the LUR only after it has received a land “allocation”, rather than a land “lease”, and where a payment in full for the land “allocation” has been made. Where the land usage fee payment is deferred, the contribution of the LUR into foreign investment projects is still permissible as far as the deferment is allowed in writing by the relevant People's Committee.

There is one exception under the Land Law where a Vietnamese party which “leases” land from the Government can make its contribution in the form of the LUR to a Joint Venture. This exception requires the two conditions as explained above to be satisfied.

After the Joint Venture is incorporated as a result of the issuance of the investment certificate by the Licensing Authority, the LURC will be issued to and in the name of the Joint Venture.

Lease term

The lease term must be consistent with the duration of the approved project provided that it must not exceed 50 years or, in some special circumstances, 70 years.

The extension of the lease term may be allowed by the Government upon expiry if the lessee wants to continue to use the land, provided that:

• the lessee has complied with the land regulations during its use period; and

• the use of land is consistent with the approved land plan.

Foreign investors wishing to extend their lease term must obtain approval to do so. Foreign investors must apply for an extension 06 months before expiration of their LURs and include in their applications an amended business or production plan approved by the relevant authorities.

Rights of foreign investors to the land leased

The LUR of foreign investors shall vary depending on the payment arrangement of land rentals. Where land is being leased from the Government, the Land Law contemplates two payment arrangements of land rental:

• annual rental payment (the “Annual Arrangement”); and

• one-off payment of rental for the entire lease term (the “One-off Arrangement”).

Under a land lease for the Annual Arrangement, the FIC could use the land only and is not allowed to transfer, sub-lease, or mortgage the LUR.

In addition to the LUR given under the Annual Arrangement regime, FICs adopting the One-off Arrangement regime have the additional rights as follows:

• rights to transfer LURs and assets attached to the land (foreign investors with an Annual Arrangement may only transfer assets attached to the land);

• rights to sublease land and assets attached to the land;

• rights to contribute LURs and assets attached to the land as capital of joint ventures; and

• rights to mortgage LURs and assets to credit institutions in Vietnam during the term of the lease.

3. Land Rent Incentives

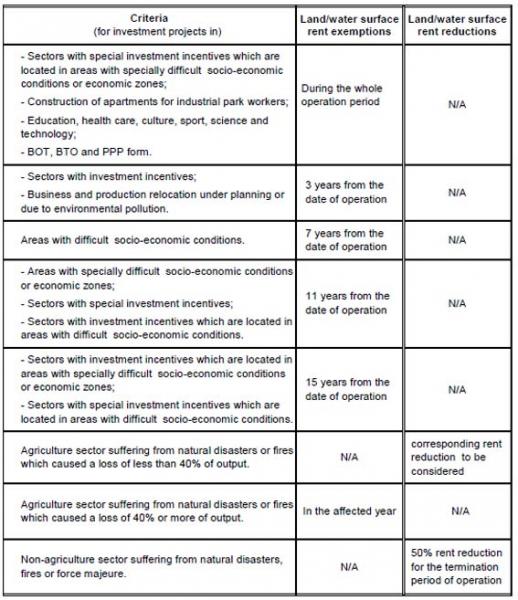

Land and water surface rent exemptions and reductions apply to a number of investment projects which satisfy certain conditions such as investment in encouraged sectors or certain fields of business and/or encouraged geographical locations. FICs and foreign parties to BCCs may enjoy land and water surface rent exemptions between 03 years to the whole operation period and land and water surface rent reduction in some cases.

Land and water surface rent exemptions and reductions

4. Land Price

Land Price is determined in three ways:

(i) by the relevant People’s Committee;

(ii) via auction; or

(iii) by land users upon transfer/lease, sublease of LURs, or contribution of LURs as capital.

The Government determines land price based on the actual value of the land under normal circumstances. If there is a large discrepancy between their calculations compared to the market price, the Government must adjust the price. The provincial People's Committee issues an official land price for each specific type of land on the first of January every year. The official land price must not be 20% higher than the maximum price or 20% lower than the minimum price of the land price framework provided by the Government.

5. Lease of Commercial Property

As an alternative to leasing a piece of land, service or software companies may consider leasing an office in a commercial building. The procedure for leasing such an office is comparatively simple and is not subject to any approval by Vietnamese authorities.

Another alternative is to lease an office or factory from another company located in an IZ or EPZ.

6. Land Clearance

Under the Land Law, foreign organizations and individuals and overseas Vietnamese investing in Vietnam are not required to pay compensation and assistance for the resettlement of residents. However, if these have been paid in advance, it will be deducted from the relevant rental.

The State will take charge of site clearance and compensation to displaced land users when withdrawing land for use by foreign organizations and individuals and overseas Vietnamese. Foreign investors may enter negotiations directly with the current land users regarding site clearance and compensation.

7. Sale of Apartments

Under the law, potential buyers of real estate projects include the following:

(a) Local Vietnamese individuals and organizations;

(b) Overseas Vietnamese who satisfy legal requirements under the laws to purchase apartments/houses in Vietnam;

(c) Foreign individuals and companies are also allowed to purchase apartments from residential projects in Vietnam. The categories of foreigners allowed to purchase apartments in Vietnam are as follows:

(i) foreigners who have direct investments in Vietnam or holding management position in a company operating in Vietnam;

(ii) foreigners who have made contribution to Vietnam and such contribution has been recognized by the President or the Prime Minister of Vietnam;

(iii) foreigners who have university degrees or higher education level and are currently working in socio-economic fields, and those who have special knowledge which Vietnam needs;

(iv) foreigners married to Vietnamese citizens;

(v) companies with foreign-invested capital operating in Vietnam which are not a real estate trading companies and have a demand of residential accommodation for its employees.

Foreign individuals are permitted to own apartments for a maximum term of 50 years and foreign companies are permitted to own apartments for a term equal to the term recorded in its investment certificate.

8. Lease of residential houses by foreigners

Currently, not every foreigner or foreign entity entering Vietnam is entitled to lease residential houses or apartments. According to the Law on Residential Housing, only the following are eligible to lease residential houses in Vietnam:

(a) Foreign organizations and individuals who are allowed to enter Vietnam for a period of at least 03 consecutive months;

(b) Vietnamese residing overseas who currently reside in Vietnam and have a need to lease a residential house.